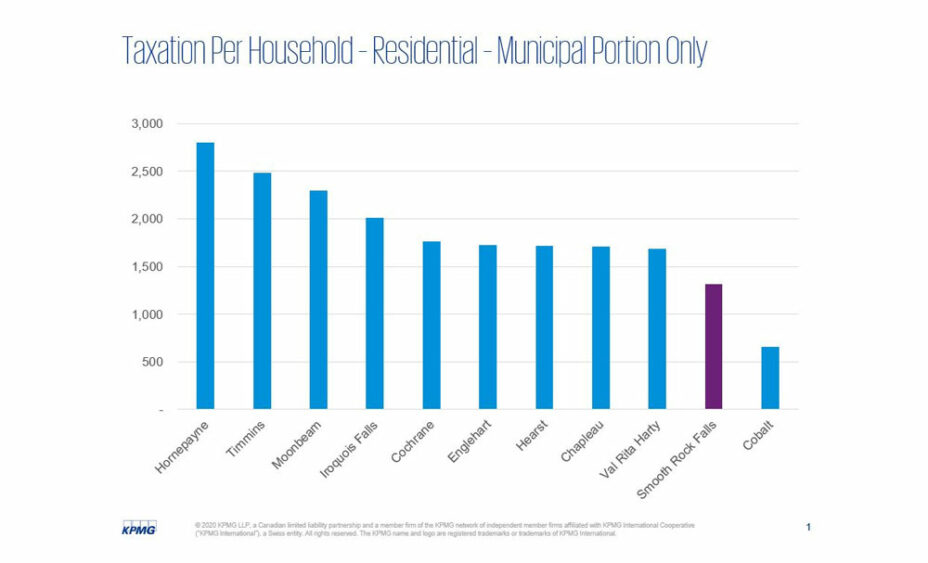

Property Tax in Smooth Rock Falls

The average MPAC assessed dwelling in Smooth Rock Falls is $68,100; and the average residential tax paid by residents of Smooth Rock Falls is one of the lowest in Northeastern Ontario according to a study done in 2015.

With friendly neighbours, beautiful surroundings, no congestion and low crime rates, you can enjoy a full, comfortable lifestyle for a fraction of the cost of urban centres in the south.

Town Hall

142 First Avenue, PO Box 249

Smooth Rock Falls, ON P0L 2B0

Tel: 705-338-2717 ext. 3

Fax: 705-338-2584

Paying Your Taxes

The Town of Smooth Rock Falls offers several convenient ways for residents and businesses to pay their property taxes.

Option 1 – In Person

Direct payment at the Town municipal office, we accept cash, debit, or cheque (no credit cards).

Option 2 – ACH

At your bank or through online banking.

Option 3 – Online

The online method of payment accepts VISA, Mastercard, American Express, Discover, and Paypal. It does require you to register but this process is fast and easy! For each transaction, 3% of the payment made and a fee of $0.35 will be added. For example: for $100.00 there would be a charge of $3.00 plus a fee of $0.35 for the transaction.

Option 4 Pre-Authorized

If you own property in the Town of Smooth Rock Falls and have no outstanding taxes, you can register for convenient pre-authorized tax payments. You can enroll all of your properties in this program. Please contact town hall for more information.

Town Hall

142 First Avenue, PO Box 249

Smooth Rock Falls, ON P0L 2B0

Tel: 705-338-2717 ext. 3

Complete the following Pre-Authorized Tax Payment Form and bring it to the front desk at the Municipal Office.

How is my property assessed?

Municipal Property Assessment Corporation

Every four years, the Municipal Property Assessment Corporation (MPAC) assesses your property’s value. MPAC is responsible for assessing and classifying all properties in Ontario in compliance with the Assessment Act and regulations set by the Government of Ontario. Every municipality in Ontario, including Smooth Rock Falls, is a member of MPAC. It provides municipalities with a range of assessment services, which includes preparing an annual assessment roll for use by a municipality in calculating property taxes.

In 2016, MPAC updated the assessed values of every property in Ontario. Their assessors looked at sales and compared your property to similar properties that have sold in your area. This approach is called Current Value Assessment.

While there are a number of factors that account for the assessment of a property, location is the most important one. As a result, comparing your assessment to similar properties in your area or neighbourhood will help you review your assessment. To find out more about how MPAC assessed properties, check out their website.

AboutMYPROPERTY

MPAC has an online service called AboutMYProperty. Through AboutMyProperty, property taxpayers can access, free of charge, property assessment information, site information, lot size and recent sales information on their own property and similar properties.

Market Trends

To learn more about the market trends in Smooth Rock Falls, check out the MarketTrends website.